Understanding TCS in GST: A Complete Guide for E-Commerce Sellers

GST UPDATES

5/19/20252 min read

Understanding TCS in GST: A Complete Guide for E-Commerce Sellers

By CA M.F. Khan

Expertise in GST, E-Commerce Compliance, and International Taxation

🔗 www.camfkhan.com

📘 What is GST TCS?

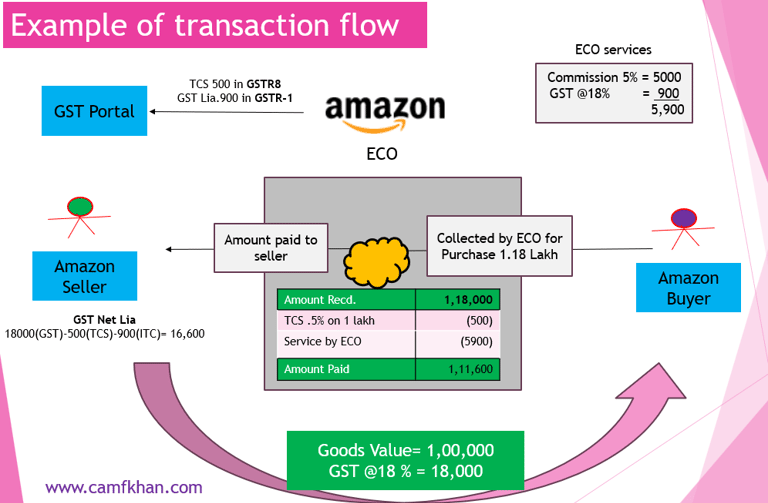

Tax Collected at Source (TCS) under GST refers to the tax that e-commerce operators (ECOs) such as Amazon, Flipkart, and Meesho are required to collect from the consideration payable to suppliers for goods or services sold through their platform.

🔄 Transaction Flow Example

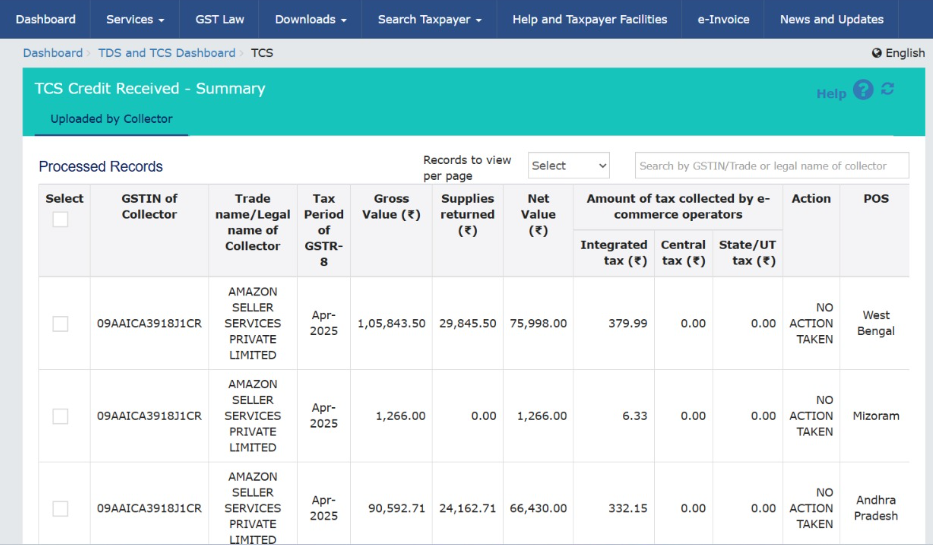

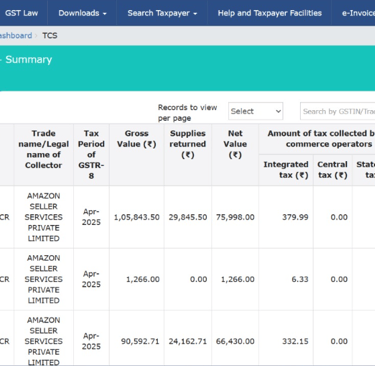

📅 State-wise TCS Reporting – GSTR-8 (May 2025)

All ECOs are required to report state-wise TCS collections under Form GSTR-8. This must align with seller records to avoid mismatches.

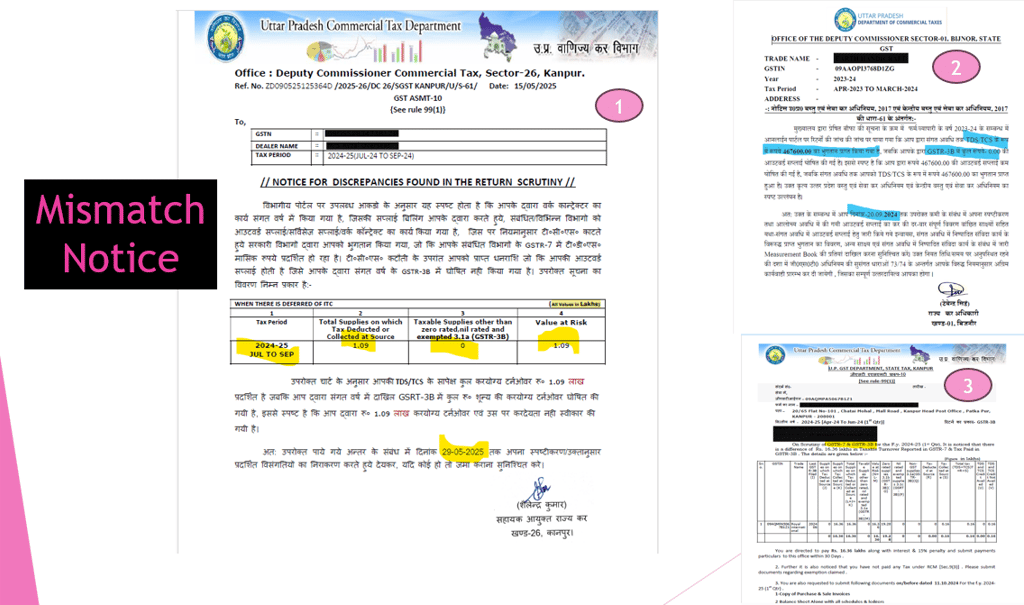

⚠️ Mismatch Notices

Mismatches between GSTR-8 filed by the ECO and GSTR-1 by the supplier can trigger GST notices. Ensure reconciliation to avoid penalties.

✅ TCS Applicability

TCS applies when:

The seller transacts through an ECO.

The ECO collects payment on behalf of the seller.

TCS does not apply if:

The ECO only facilitates the sale without handling payments.

❌ Non-Applicability Scenarios

TCS is not applicable for:

ECOs notified under Section 9(5) (e.g., hotel booking, certain restaurant services).

Supplies from a seller’s own website.

Goods sold as an agent.

Composite supply from multiple vendors.

Exempt or import transactions.

📊 TCS Rate

CGST: 0.25%

SGST: 0.25%

IGST: 0.5% (inter-state)

➡️ Effective Rate: 0.5% of net taxable value.

📝 Filing Requirements

ECOs must:

File GSTR-8 by the 10th of every month.

Pay TCS using the e-Cash Ledger.

Sellers will find the TCS credit reflected in their electronic cash ledger.

🔍 TCS vs. Income Tax TDS (Section 194-O)

GST TCS is an indirect tax on supply.

Income Tax TDS u/s 194-O is 0.1% on gross sales and is an income tax obligation.

They are governed by different laws and require separate compliance.

Thank You

M.F. Khan & Associates

A CA firm based in India, with international associations in UAE and the USA.

We specialize in:

Indian EXIM Compliance

E-Commerce Export

Income Tax, Audit, GST

UAE Corporate Tax & VAT

USA LLC & UK VAT Services

📍 Visit us at www.camfkhan.com

Excellence

You can search online for chartered accountant, CA in Kanpur, CA near me, best ca India, best ca firm in kanpur, top CA Firm in Kanpur, India. Top Tax Consultant in Dubai, Tax Consultant in UAE, Corporate Tax consultant in dubai.

mfkhan.associates@gmail.com

India : whatsApp +918318147596

© 2022. All rights reserved.

Dubai : whatsApp +971524778300